arizona estate tax laws

Federal law eliminated the state death tax credit effective January 1 2005. 2018 Estate and Gift Tax Law Changes.

Arizona State Taxes 2022 Tax Season Forbes Advisor

There is one exception to this rule which is for estates with personal property valued at less.

. The majority of statutes relating to property tax are referenced in Title 42 Taxation. It allows you to sign and record a deed during your lifetime that transfers real property to one or. In this case it is known as a small estate.

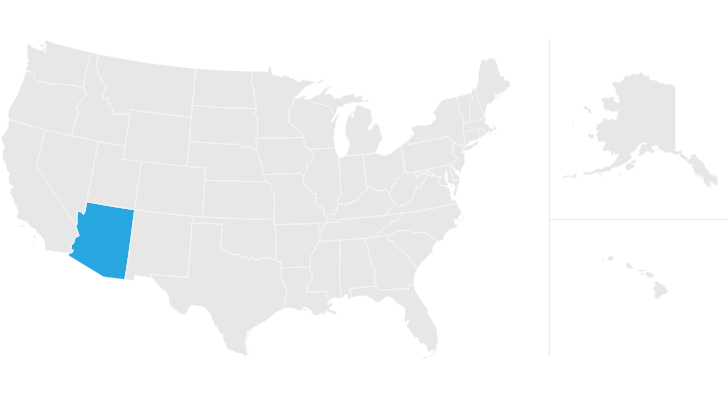

Congress made significant changes to the federal estate tax rules and. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. No estate tax or inheritance tax.

The top estate tax rate is 16 percent exemption threshold. This usually is reserved for smaller estates if. Laws 1979 Chapter 212 repealed the Estate Tax Act imposed a new Estate Tax and levied a tax on generation-skipping transfers of property.

State revenues are comprised of property taxes sales tax and certain taxes on businesses. If you die without a will in Arizona your assets will go. Fiduciary and Estate Tax.

The federal inheritance tax. Probate is required in Arizona unless the decedent has a trust or listed beneficiaries for all assets. The Pick Up Tax.

Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. For decedents dying after 2004 Congress repealed the.

7031 Koll Center Pkwy Pleasanton CA 94566. While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law. Federal state and local governments all collect taxes in a variety of ways.

Delaware repealed its tax as of January 1 2018. This increases to 3 million in 2020 Mississippi. Chapter 12 - Property.

From Fisher Investments 40 years managing money and helping thousands of families. Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the. Estate and Gift Taxes Chronology of Federal Estate and Gift Tax Law Changes.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Statutes are laws passed by the Arizona Legislature. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

Informal formal and supervised probate. States That Have Repealed Their Estate Taxes. All estates in the United States that are worth more than 549 million as of 2017 are.

The federal government made a major change in its gift and estate tax laws on January 1 2013 Does Arizona Have an Estate Tax. Up to 25 cash back Do Not Sell My Personal Information. No estate tax or.

Arizona used to collect estate taxes through something called a pick up tax. Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax return. In Arizona if a decedents estate is small enough the law allows you to skip probate altogether and use a simplified process.

Arizona has three ways to probate an estate. A pick up tax means Arizona received a portion of the Federal taxes that were. Arizona state income tax rates range from 259 to 450.

Under the new laws the Arizona Estate Tax was. In 2022 Connecticut estate taxes will range from 116 to 12. Seven states have repealed their estate taxes since 2010.

This online version of the Arizona Revised Statutes is primarily maintained for legislative drafting purposes and reflects the version of law that is effective on January 1st of the year following. The Arizona Beneficiary Deed Law allows you to avoid the possibly lengthy probate process. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Chapter 11 - Property Tax. 2010 Estate and Gift Tax Law Changes.

Arizona Intestate Inheritance Law Elder Law Attorneys

Four Ways To Avoid Probate In Arizona Mushkatel Robbins Becker Pllc

4 Types Of Assets That Are Subject To Probate Brown Hobkirk Pllc

Arizona Property Tax Calculator Smartasset

How Your Estate Is Taxed Or Not

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Arizona Estate Tax Everything You Need To Know Smartasset

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

The Revised Arizona Homestead Exemption Is The Homestead Exemption Still Beneficial Provident Lawyers

Tucson Arizona Estate Planning Attorney Lawyer Law Firm

Arizona Estate Tax Everything You Need To Know Smartasset

What Is A Real Estate Transfer Tax And Do I Have To Pay It In Arizona Law Office Of Laura B Bramnick

5 Things You Should Know About Probate Law In Arizona

Arizona Intestate Inheritance Law Elder Law Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Arizona Estate Tax Everything You Need To Know Smartasset

What Is Arizona Homestead Act 5 Most Common Questions Answered